Early this year, the Pass-through Business Alternative Income Tax Act was passed in New Jersey to give pass-through entities a workaround to the $10,000 cap on state and local tax deductions imposed by the Tax Cuts and Jobs Act of 2017. The bill allows residents and non-residents who receive NJ-sourced income from pass-through entities to pay a business alternative income tax (BAIT) and receive a credit for all or part of this tax against their own personal state tax liability – effectively treating the state tax obligation as a business expense.

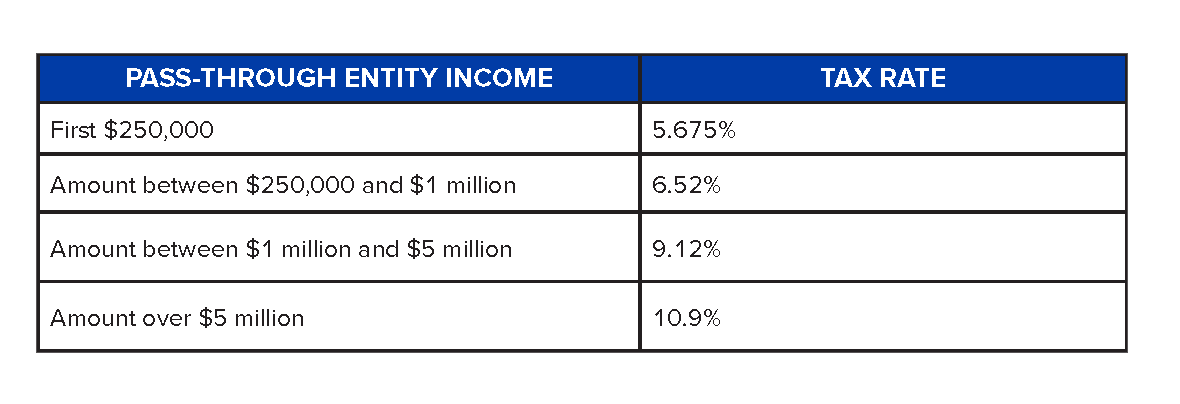

Effective for tax years beginning on or after January 1, 2020, the legislation gives the state’s S-corporations, partnerships and limited liability companies (with more than one member) the option to elect a pass-through entity tax rate between 5.675% and 10.9% based on pass-through income. The members then receive a credit against their gross income tax equal to each member’s share of distributive proceeds paid by the pass-through entity.

The tax rate is determined by the following thresholds:

IRS Reaction

When the New Jersey legislation was signed, it was unclear if the IRS would allow the deduction on a federal return.

IRS Notice 2020-75 answered this question and brought welcome news to already beleaguered businesses in high-tax states. The Notice states that the Treasury and IRS will issue proposed regulations to clarify that state and local income taxes and paid by a partnership or an S Corporation on the entity’s income are fully deductible when computing the entity’s taxable income or loss on its federal tax return.

To understand the significance of this development, consider the following scenario:

- $10 million of NJ taxable income generates a BAIT tax of $972,887.

- This $972,887 can be deducted at the federal level (bypassing the $10,000 cap on state and local tax deductions).

- Federal income tax savings for a taxpayer in the highest bracket will be $359,968 ($972,887 * 37%)

Using the Workaround in 2020

NJ entities must make the BAIT election each year before the entity’s tax due date. The election cannot be made retroactively.

Since 2020 is the first year the Pass-through BAIT is available, taxpayers are protected a under safe harbor provision that waives underpayment penalties for estimated tax payments. Owners of entities who make the election will receive a credit against their gross income tax equal to their share of distributive proceeds. Non-residents can participate on a Form NJ-1080-C composite return and take a credit for taxes paid.

In order to receive credit for current year estimated tax payments, cash-basis taxpayers must make the payments electronically by December 31, 2020 (otherwise due by March 15, 2021).

2021 Estimated Taxes

New Jersey estimated taxes for 2021 will follow the standard individual estimated tax periods. Estimated tax forms for affected entities are not yet available, but payments can be made on the NJ Division of Taxation website.

If you have any questions about using the NJ BAIT rate or claiming the federal deduction under cash basis or accrual basis accounting methods, please reach out to your Grassi tax advisor or contact Michael Hochman, Partner and NJ Market Leader, at mhochman@grassiadvisors.com.